Blind patriotism encouraging further centralization of mining in America is a regulatory capture trap.

This is an opinion editorial by Shinobi, a self-taught educator in the Bitcoin space and tech-oriented Bitcoin podcast host.

Since the mining ban came to China, there has been a massive migration of Bitcoin hash rate to the United States. There have been many narratives and pushes from pro-American Bitcoiners to continue attracting more hash rate to the U.S., including pushing to create favorable regulatory environments for miners here in North America. This has been done under the premise of the historical strength of American property rights, which is a big part of why American capital and equity markets are the biggest in the world.

This is a huge miscalculation and is something that, if successful, will have a huge negative effect on Bitcoin in the long run. The entire game theory around the security of Bitcoin mining is decentralization/distribution. From day one it has been very clearly delineated that a majority (51%) or more of the Bitcoin hash rate can act maliciously in a way that severely degrades or entirely breaks the security of the entire system. They can orphan blocks from other miners, preventing them from even participating in the system to earn revenue in Bitcoin. They can exclude transactions from parties they do not wish to transact, again orphaning the blocks from any miners processing such transactions from the blockchain. They could selectively refuse to process Lightning channel closures properly, they could prevent peg ins or peg outs from sidechains. They can entirely break the censorship resistance of the system and undermine the security of not only the base layer but any secondary layer built on top of it to scale the system.

Miners themselves deciding of their own volition to act maliciously is not the only form that this particular risk takes. They have to set up their operation somewhere, which means — unless they are able to successfully operate illegally and invisibly off-grid, which is not practical at scale — they have to subject themselves to the laws and regulations of the jurisdiction they set up in. Too much of the total network hash rate being in a single jurisdiction represents a security risk to the network as a whole. Think of how much of the hash rate is currently running in the United States, and how much of that is public companies, registered co-hosting facilities, easily locatable businesses and people with enough hash rate at home with a power signature easily identified by a utility company. All of this hash rate is subject to enforcement action from the U.S. government with varying degrees of difficulty. And by varying I mean, everything except individual home miners could probably be trivially accomplished within the span of a single week.

As of December 2021 the Cambridge Bitcoin Electricity Consumption Index shows 38% of the network hash rate as located in the United States. That is 13% shy of the bare minimum necessary to engage in disruptive activity on the network. Bitcoiners should not be encouraging action and legislation to tip this even closer to that inflection point. The United States government is the biggest empire in the world, we literally operate the world’s reserve currency, which is already facing big trouble in the world just due to the political fallout in response to decades of us engaging in a foreign policy centered almost entirely around benefitting America at the cost of harming countless other nations of the world.

Bitcoin is yet another existential threat to that reserve currency and to the benefits of the rest of the world relying on it entails. Things are constantly painted as if America is some shining beacon of freedom in the world that will embrace Bitcoin because of that, and in some ways America is that beacon, but in other ways it is eerily similar to the totalitarian state of China under the thumb of the CCP. The American government has every incentive to attack or capture Bitcoin that China does, even more in the case of the threat that Bitcoin represents to the U.S. Dollar. Bitcoin is a fundamental threat to the world order that the American Empire has established. If the government sees an opportunity to neuter that threat, they will take it.

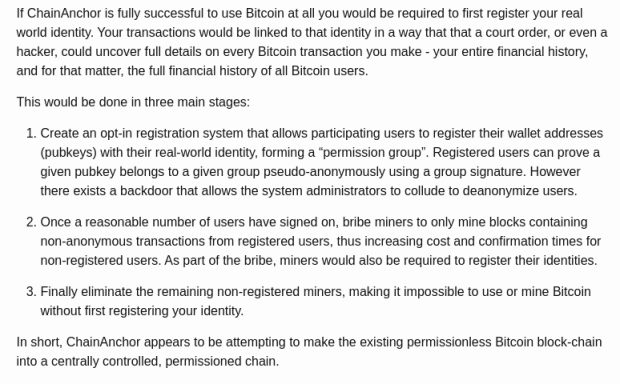

Performing such attacks isn’t a simple intellectual exercise with the government having no clue or plans how to do anything either. In 2016 MIT designed a system called Chain Anchor. The entire goal of the system is literally performing a 51% attack to permanently neuter Bitcoin’s censorship resistance:

Read all of that carefully. Now consider the FATF regulations that have been dragging and slowly being rolled out over the last few years. The Travel Rule. Almost every big exchange in this ecosystem is actively working on protocols to allow them to exchange personally identifying information with each other, or at least commitments to it, whenever they engage in a transaction on behalf of one of their users that goes directly to another exchange. That wouldn’t be opt in — that’s a mandate, even worse than the proposal in Chain Anchor. European politicians have even danced on the line with proposals publicly to extend such KYC requirements to non-custodial wallets.

Now consider the current dominance of ESG narratives in relation to Bitcoin mining. There are talks of (and literally regulations enforcing it in some places) preferential treatment of renewable energy powered mining. In general, these involve economic incentives in the form of tax breaks/subsidies for operations. These types of non-Bitcoin economic deals, and in the future even outright payments potentially, are an exact form of bribing miners. They are economically incentivizing them to act in a specific way outside of the Bitcoin protocol itself.

These actions are slowly normalizing the idea of miners acting with such protocol-external incentives in mind. Public mining companies don’t get such deals without identifying themselves, consumers don’t get rack space at a co-hosting facility without KYCing themselves. All of this is the requirements for Chain Anchor creeping in slowly.

All that’s left is the necessary hash rate required to entirely enforce whitelisted use of Bitcoin and exclude non-compliant miners from the system, and bam, Chain Anchor’ has effectively neutered and turned Bitcoin into a whitelisted and permissioned system. At that point there is no option except hope that new miners can be produced and brought online to overwhelm this attacking majority, which is a long shot given how centralized ASIC design and production is in reality.

Other than that, the only option is to change the PoW algorithm. This is, I believe, even in the face of such an attack, highly unlikely. It draws into question the entire idea of a neutral system, and indiscriminately destroys the value of malicious and non-malicious miners’ investments alike. As well, again looking at the centralization of ASIC production, once this attack has been demonstrated as feasible nothing is to stop it from being done again. Nuking the prior generation of ASICs in a fork also disincentivizes honest miners from trying again. What happens if another fork occurs because the attack is pulled again? They run the risk of once again sinking a large amount of capital into a hardware investment that is rendered worthless by responding to the attack.

I do not believe Bitcoin could recover from such an attack. People will either suck it up, and value it for what it is simply as a scarce economic asset devoid of true censorship resistance, or it will fail outright. If a game of socially coordinated whack-a-mole is necessary to keep it functioning in a censorship resistant fashion, that completely undermines the value of a neutral censorship resistant system that doesn’t require such social coordination to function. It either dies, or it limps on as a neutered scarce asset.

For Bitcoin to truly work as a censorship resistant system, it needs to avoid winding up in that situation in the first place. Bitcoiners should not be cheering on such hashrate concentration in a single jurisdiction, and trying to further encourage it by lobbying industry and politicians to make things even more favorable for miners to concentrate in a single place. Unthinking patriotism and hyperfocus on “Make America Great Again” in that way is not something that is good for Bitcoin — in fact it is actively dangerous for it.

If Bitcoin is going to succeed, it needs to succeed as a system distributed safely and securely all across the world, not heavily concentrated in America because “America is great.”

This is a guest post by Shinobi. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.