A look ahead at what’s in store for bitcoin in the coming year. We analyze seven aspects of what might impact the bitcoin price in 2023.

The below is an excerpt from a recent year-ahead report written by the Bitcoin Magazine PRO analysts. Download the entire report here.

Bitcoin Magazine PRO sees incredibly strong fundamentals in the Bitcoin network and we are laser-focused on its market dynamic in the context of macroeconomic trends. Bitcoin aims to become the world reserve currency, an investment opportunity that cannot be understated.

In our year-ahead report, we analyzed seven notable factors that we recommend investors pay attention to in the coming months.

Convicted Bitcoin Investors

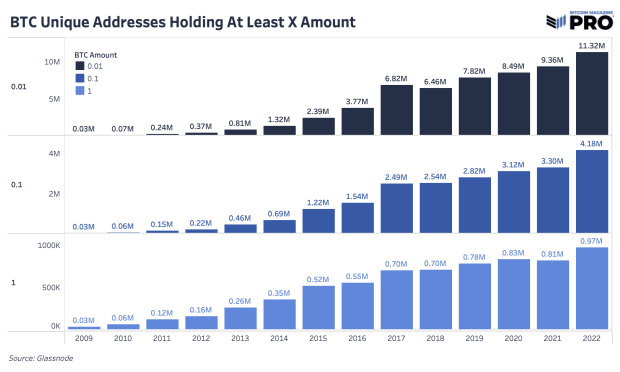

We can put investor conviction into perspective by looking at the number of unique Bitcoin addresses holding at least 0.01, 0.1 and 1 bitcoin. This data shows that bitcoin adoption continues to grow with a growing number of unique addresses holding at least these amounts of bitcoin. While it is entirely possible for individual users to hold their bitcoin in multiple addresses, the growth of unique Bitcoin addresses holding at least 0.01, 0.1 and 1 bitcoin indicate that more users than ever before are buying bitcoin and holding it in self-custody.

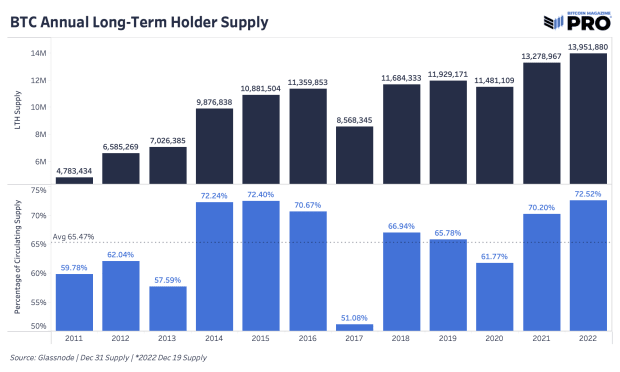

Another promising metric is the amount held by long-term holders, which has increased to almost 14 million bitcoin. Long-term holder supply is calculated using a threshold of a 155-day holding period, after which dormant coins become increasingly unlikely to be spent. As of now, 72.49% of the bitcoin in circulation is not likely to be sold at these prices.

There is a large subset of bitcoin investors who are accumulating the digital asset no matter the price. In a December 2022 interview on “Going Digital,” Head of Market Research Dylan LeClair said, “You have people all over the world that are acquiring this asset and you have a huge and growing cohort of people that are price-agnostic accumulators.”

With a growing number of unique addresses holding bitcoin and such a significant amount of bitcoin being held by long-term investors, we are optimistic for bitcoin’s advancement and rate of adoption. There are many variables that demonstrate the potential for asymmetric returns as demand for bitcoin increases and adoption increases worldwide.

Total Addressable Market

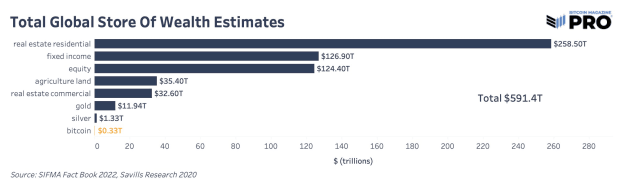

During monetization, a currency goes through three phases in order: store of value, medium of exchange and unit of account. Bitcoin is currently in its store-of-value phase as demonstrated by the long-term holder metrics above. Other assets that are frequently used as stores of value are real estate, gold and equities. Bitcoin is a better store of value for many reasons: it is more liquid, easier to access, transport and secure, easier to audit and more finitely scarce than any other asset with its hard-cap limit of 21 million coins. For bitcoin to acquire a larger share of other global stores of value, these properties need to remain intact and prove themselves in the eyes of investors.

As readers can see, bitcoin is a tiny fraction of global wealth. Should bitcoin take even a 1% share from these other stores of value, the market cap would be $5.9 trillion, putting bitcoin at over $300,000 per coin. These are conservative numbers from our viewpoint because we estimate that bitcoin adoption will happen gradually, and then suddenly.

Transfer Volume

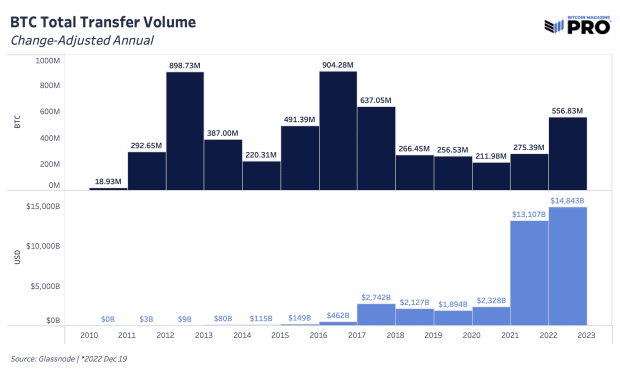

When looking at the amount of value that was cleared on the Bitcoin network throughout its history, there is a clear upward trend in USD terms with a heightened demand for transferring bitcoin this year. In 2022, there was a change-adjusted transfer volume of over 556 million bitcoin settled on the Bitcoin network, up 102% from 2021. In USD terms, the Bitcoin network settled just shy of $15 trillion in value in 2022.

Bitcoin’s censorship resistance is an extremely valuable feature as the world enters into a period of deglobalization. With a market capitalization of only $324 billion, we believe bitcoin is severely undervalued. Despite the drop in price, the Bitcoin network transferred more value in USD terms than ever before.

Rare Opportunity In Bitcoin’s Price

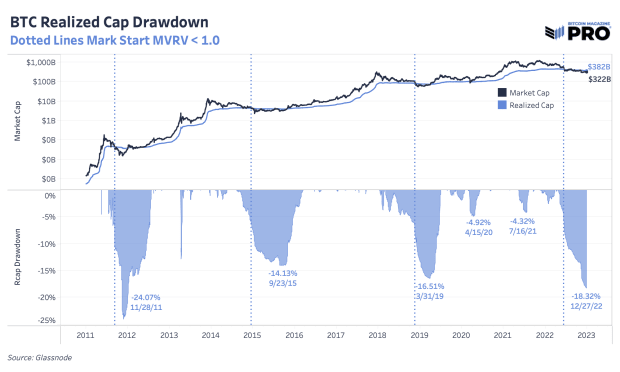

By looking at certain metrics, we can analyze the unique opportunity investors have to purchase bitcoin at these prices. The bitcoin realized market cap is down 18.8% from all-time highs, which is the second-largest drawdown in its history. While the macroeconomic factors are something to keep in mind, we believe that this is a rare buying opportunity.

Relative to its history, bitcoin is at the phase of the cycle where it’s about as cheap as it gets. Its current market exchange rate is approximately 20% lower than its average cost basis on-chain, which has only happened at or near the local bottom of bitcoin market cycles.

Current prices of bitcoin are in rare territory for investors looking to get in at a low exchange rate. Historically, purchasing bitcoin during these times has brought tremendous returns in the long term. With that said, readers should consider the reality that 2023 likely brings about bitcoin’s first experience with a prolonged economic recession.

Macroeconomic Environment

As we move into 2023, it’s necessary to recognize the state of the geopolitical landscape because macro is the driving force behind economic growth. People around the world are experiencing a monetary policy lag effect from last year’s central bank decisions. The U.S. and EU are in recessionary territory, China is proceeding to de-dollarize and the Bank of Japan raised its target rate for yield curve control. All of these have a large influence on capital markets.

Nothing in financial markets occurs in a vacuum. Bitcoin’s ascent through 2020 and 2021 — while similar to previous crypto-native market cycles — was very much tied to the explosion of liquidity sloshing around the financial system after COVID. While 2020 and 2021 was characterized by the insertion of additional liquidity, 2022 has been characterized by the removal of liquidity.

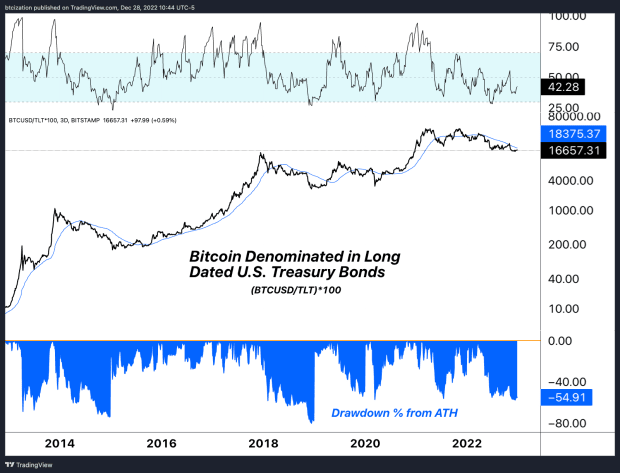

Interestingly enough, when denominating bitcoin against U.S. Treasury bonds (which we believe to be bitcoin’s largest theoretical competitor for monetary value over the long term), comparing the drawdown during 2022 was rather benign compared to drawdowns in bitcoin’s history.

As we wrote in “The Everything Bubble: Markets At A Crossroads,” “Despite the recent bounce in stocks and bonds, we aren’t convinced that we have seen the worst of the deflationary pressures from the global liquidity cycle.”

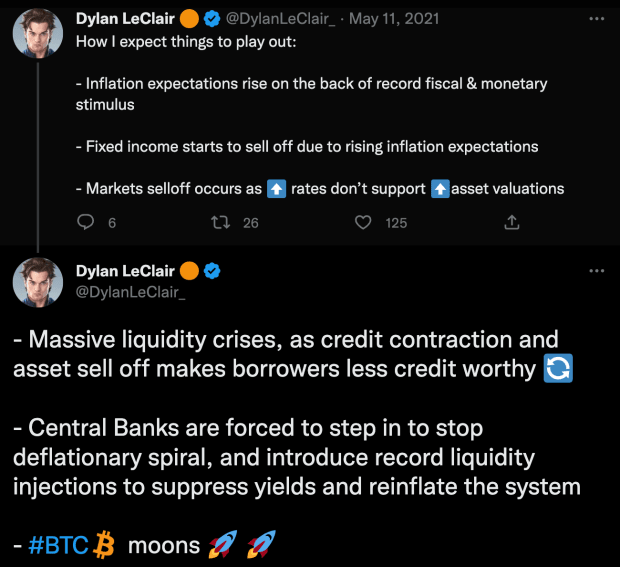

In “The Bank of Japan Blinks And Markets Tremble,” we noted, “As we continue to refer to the sovereign debt bubble, readers should understand what this dramatic upward repricing in global yields means for asset prices. As bond yields remain at elevated levels far above recent years, asset valuations based on discounted cash flows fall.” Bitcoin does not rely on cash flows, but it will certainly be impacted by this repricing of global yields. We believe we are currently at the third bullet point of the following playing out:

Bitcoin Mining And Infrastructure

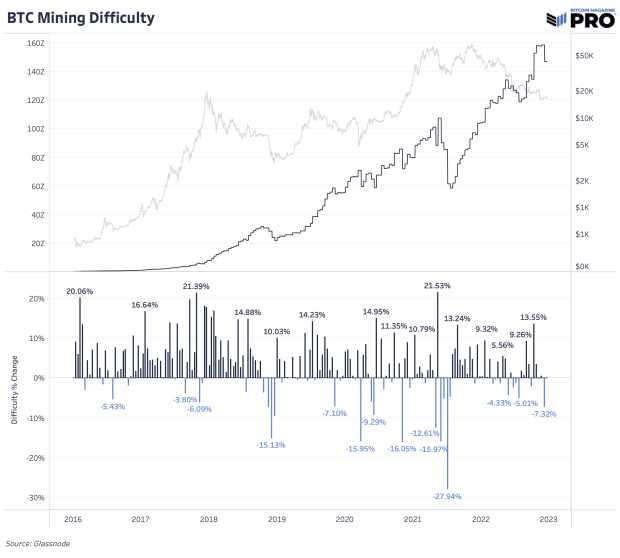

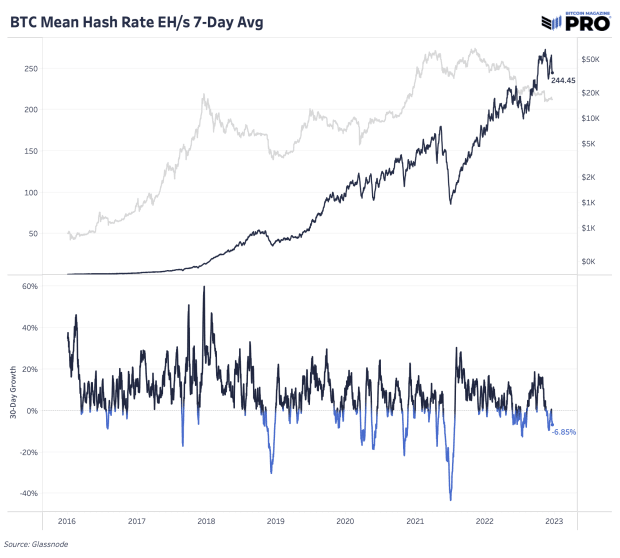

While the multitude of negative industry and worrying macroeconomic factors have had a major dampening on bitcoin’s price, looking at the metrics of the Bitcoin network itself tell another story. The hash rate and mining difficulty gives a glimpse into how many ASICs are dedicating hashing power to the network and how competitive it is to mine bitcoin. These numbers move in tandem and both have almost exclusively gone up in 2022, despite the significant drop in price.

By deploying more machines and investing in expanded infrastructure, bitcoin miners demonstrate that they are more bullish than ever. The last time the bitcoin price was in a similar range in 2017, the network hash rate was one-fifth of current levels. This means that there has been a fivefold increase in bitcoin mining machines being plugged in and efficiency upgrades to the machines themselves, not to mention the major investments in facilities and data centers to house the equipment.

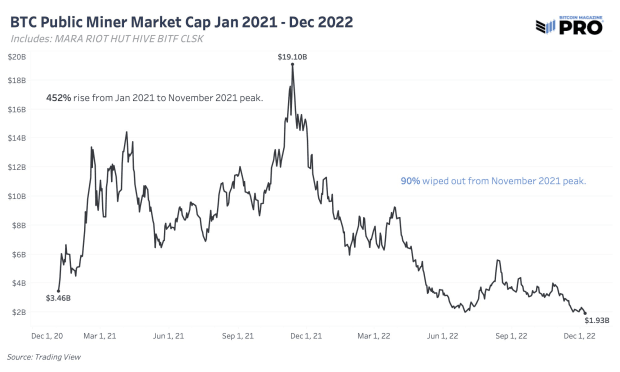

Because the hash rate increased while the bitcoin price decreased, miner revenue took a beating this year after a euphoric rise in 2021. Public miner stock valuations followed the same path with valuations falling even more than the bitcoin price, all while the Bitcoin network’s hash rate continued to rise. In the “State Of The Mining Industry: Survival Of The Fittest,” we looked at the total market capitalization of public miners which fell by over 90% since January 2021.

We expect more of these companies to face challenging conditions because of the skyrocketing global energy prices and interest rates mentioned above.

Increasing Scarcity

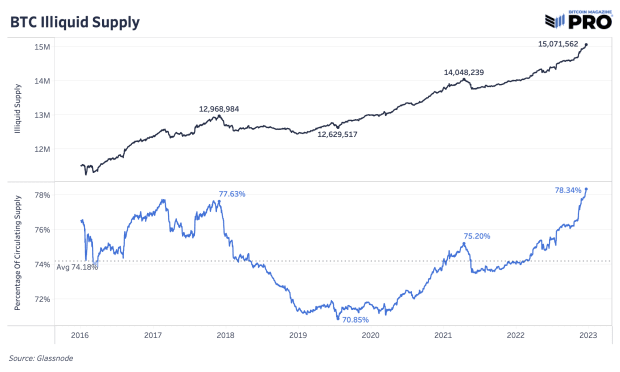

One way to analyze bitcoin’s scarcity is by looking at the illiquid supply of coins. Liquidity is quantified as the extent to which an entity spends their bitcoin. Someone that never sells has a liquidity value of 0 whereas someone who buys and sells bitcoin all the time has a value of 1. With this quantification, circulating supply can be broken down into three categories: highly liquid, liquid and illiquid supply.

Illiquid supply is defined as entities that hold over 75% of the bitcoin they deposit to an address. Highly liquid supply is defined as entities that hold less than 25%. Liquid supply is between the two. This illiquid supply quantification and analysis was developed by Rafael Schultze-Kraft, co-founder and CTO of Glassnode.

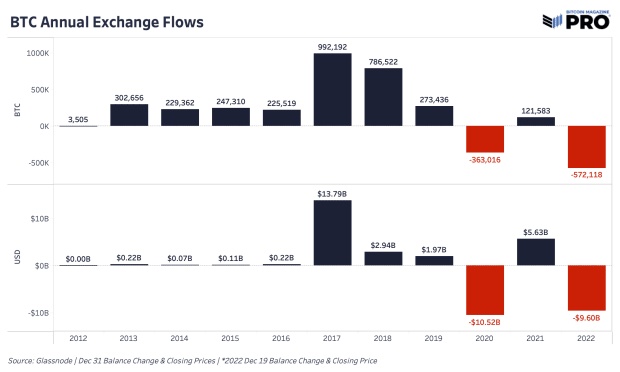

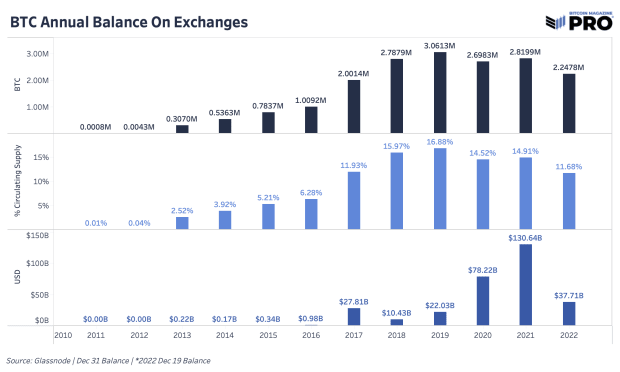

2022 was the year of getting bitcoin off exchanges. Every recent major panic became a catalyst for more individuals and institutions to move coins into their own custody, find custody solutions outside of exchanges or sell off their bitcoin entirely. When centralized institutions and counterparty risks are flashing red, people rush for the exit. We can see some of this behavior through bitcoin outflows from exchanges.

In 2022, 572,118 bitcoin worth $9.6 billion left exchanges, marking it the largest annual outflow of bitcoin in BTC terms in history. In USD terms, it was second only to 2020, which was driven by the March 2020 COVID crash. 11.68% of bitcoin supply is now estimated to be on exchanges, down from 16.88% back in 2019.

These metrics of an increasingly illiquid supply paired with historic amounts of bitcoin being withdrawn from exchanges — ostensibly being removed from the market — paint a different picture than what we’re seeing with the factors outside of the Bitcoin network’s purview. While there are unanswered questions from a macroeconomic perspective, bitcoin miners continue to invest in equipment and on-chain data shows that bitcoin holders aren’t planning to relinquish their bitcoin anytime soon.

Conclusion

The varying factors detailed above give a picture for why we are long-term bullish on the bitcoin price going into 2023. The Bitcoin network continues to add another block approximately every 10 minutes, more miners keep investing in infrastructure by plugging in machines and long-term holders are unwavering in their conviction, as shown by on-chain data.

With bitcoin’s ever-increasing scarcity, the supply side of this equation is fixed, while demand is likely to increase. Bitcoin investors can get ahead of the demand curve by averaging in while the price is low. It’s important for investors to take the time to learn how Bitcoin works to fully understand what it is they are investing in. Bitcoin is the first digitally native and finitely scarce bearer asset. We recommend readers learn about self-custody and withdraw their bitcoin from exchanges. Despite the negative news cycle and drop in bitcoin price, our bullish conviction for bitcoin’s long-term value proposition remains unfazed.

For the full report, follow this link to subscribe to Bitcoin Magazine PRO.