Bitcoiners have a higher chance of making meaningful change in state-level Bitcoin policy by building relationships with their local politicians.

This is an opinion editorial by Dennis Porter, CEO of Satoshi Action Fund and political strategist who focuses on defending Bitcoin infrastructure and industry in the U.S. through public policy, activism and advocacy.

The unlimited money printer and where that unlimited money gets spent is the ultimate power of our day. The broad power of the federal government — including the unlimited money in Washington — attracts many interest groups to our nation’s capital, but that is also exactly why Bitcoiners should pick a different strategy. Historically, many political movements have taken place at the state and local level, but currently Bitcoiners are leaning heavily into influencing policy at the federal level. I will admit, I have fallen for the luster of the federal government in the past. In order for Bitcoin to succeed in the USA, I believe we must focus more of our efforts on local politics. Not only is this a better political strategy, it is also in line with the ethos of Bitcoin’s grassroots, bottom-up design. It doesn’t get any more bottom-up than meeting with your local and state representatives to impact public policy. The rest of this piece will be used to explain the value in this approach. By the time you finish reading, I hope you will be convinced to take action to positively impact your local community.

It has been nearly one year since the infrastructure bill was passed and ever since then, we, as an industry, have been extremely focused on Washington. For good reason; the infrastructure bill forced us to pay attention as the most powerful government in the world began to target the Bitcoin industry. Soon after, we collectively watched as many Bitcoiners became politically active, with even some of the most anti-government Bitcoin influencers launching their own political organizations and efforts to combat government overreach.

I began working overtime to build relationships with members of Congress. In a single year, I made friends with more senators and members of Congress than I have in the first 30-plus years of my adult life, despite having a background in politics. Since the infrastructure bill was announced many relationships were made, but not much has happened to advance Bitcoin policy. Incremental gains have occurred, but they have been overwhelmed with moves in the wrong direction.

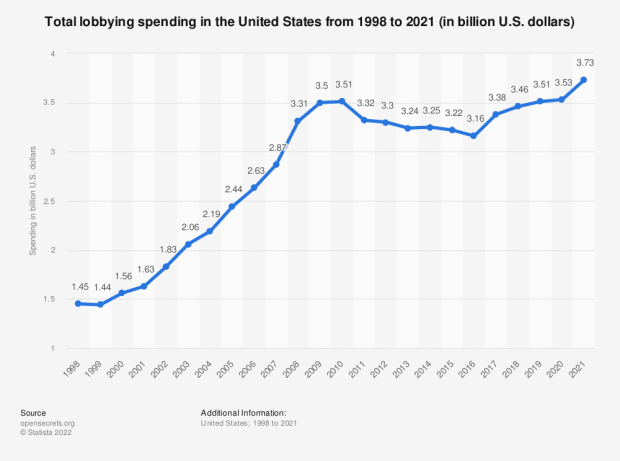

The positive outcomes have been extremely mild in comparison to the efforts in Washington and there is a reason for it. As I mentioned above, there are simply too many interest groups in the district. Bitcoin might be popular in the news and on Twitter, but our ability to properly lobby pales in comparison to the military industrial complex or the medical industry, for example. We simply aren’t big enough. For reference, the entire cryptocurrency universe (including Coinbase) spent almost $9 million in 2021 on political lobbying efforts, while the healthcare industry spent over $625 million in that same year. In total, over $3.7 billion was spent across all major industries. At $9 million, this puts the entire cryptocurrency space at 0.2% of all lobbying expenditures; we are a rounding error. I am not saying this to disappoint, but we do need a reality check. I woke up to the realization that we simply are not big enough to be truly effective at the federal level despite how much attention we get in the news or on Twitter.

That being said, the efforts should not stop and I encourage those who have successfully built relationships in Washington D.C. to continue fighting for Bitcoin. Do not lose hope. There is a cavalry coming to help bolster your efforts, and that cavalry is state and local politics. We are fortunate to live in a republic where the states have sovereign power; this gives American Bitcoiners a unique ability to let grassroots efforts rise from the bottom, regardless of what happens at the federal level. A lot has been done to weaken the ability of states to have an impact on the political process over the decades, but I believe there will be a revival of activity at the state level and Bitcoiners have an opportunity to front-run this move.

As many of you know, this country is riddled with successful movements which have and are occurring at the state and local levels. The simplest example of a state-level movement is marijuana. In 2012, two states (Washington and Colorado) became the first to legalize marijuana. Only 10 years later, there are now 39 states which have made medical and/or recreational marijuana fully legal in their borders with five of the 11 remaining states voting on legalization in 2022.

This example is critical for Bitcoiners to remember. It is possible that in nearly a decade, almost 90% of the U.S. will have pro-marijuana legislation on its books at the state level; an incredible feat for any major political issue to accomplish, especially considering that possessing marijuana is still a federal crime. This goes to show the power of the bottom-up approach that is only possible due to the design of the governance structure in the U.S.

This is the same approach I believe Bitcoiners need to take in order for us to be truly successful in our political efforts. Another reason local government is an attractive approach is there is much less attention on local politics. Many elected state representatives work part time and some are volunteers, which means they also don’t have a lot of help. Often, local officials care deeply about their state and truly do want to make a difference. The desire of a local official to make a difference, combined with a Bitcoiner’s enthusiasm to help, is a good mix. Many state houses also have less attention from those that wish to slow Bitcoin down.

Less enemies means less roadblocks which means we can move a lot quicker.

Many states are also much more willing to experiment with new policy and once one state adopts a piece of policy, it sets off a game-theoretical chain reaction where other states could begin adopting the same or similar policy. Many states simply copy/paste policy from others in an effort to avoid being outcompeted, but also it’s just easier than coming up with new concepts.

As New York State Senator James Sanders said, “We should not spend all of our time creating the wheel, I prefer to perfect it.” In the case of marijuana legislation, not legalizing meant missed tax dollars and jobs. In the case of bitcoin mining, it means missing out on potential jobs, innovation and investment and not being able to improve grid infrastructure. Once one state moves in the right direction, legislators from other states will see the results and begin looking for ways to improve upon them in their own state. Fortunately, we already have a state to look to for a roadmap to success for Bitcoin policy: Texas.

I believe that the next five years will be filled with dramatic moves at the state level. We should care about these efforts at the state level for three reasons and we should take the opportunity to move on them as quickly as possible while being conscious of an effort to form effective and long-standing policy.

- We have the opportunity to advance Bitcoin and bitcoin mining through states that are ready and willing to move in the right direction. We can do it quickly and efficiently.

- If we do nothing, more states will be drawn to following New York. It will hurt our efforts to become active later rather than sooner.

- If we can get a groundswell of states to pass pro-Bitcoin policy (copy/paste), especially mining policy, we can blunt or stop efforts at the federal level to hamper Bitcoin adoption in the U.S. and North America.

Call To Action

I have been telling many of you to get a lot more active in politics and many of you have taken action. I see you. I am once again asking you to get more active, but this time: think local. Find your local state representative and ask them how you can help. Build relationships and tell them about the opportunity for them to adopt bitcoin mining as a way to bolster your local economy. If you need help educating them, reach out to Satoshi Action Fund or email me. Satoshi Action is a nonprofit dedicated to educating policymakers and regulators on the benefits of Bitcoin and bitcoin mining.

In closing, I believe the next decade will be critical for bitcoin adoption and the most effective way to improve that adoption from the nation-state perspective is to start at the local level. Remember, there was Bitcoin Beach (local level) long before there was bitcoin as legal tender in El Salvador (national level).

This is a guest post by Dennis Porter. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc. or Bitcoin Magazine.