The adoption of bitcoin as legal tender has introduced some controversy — but also undeniable benefits to the country.

This is an opinion editorial by Gaby Vivas, an entrepreneur in Latin America providing outsourcing services worldwide and a long-term investor in bitcoin.

El Salvador made history by becoming the first state to use bitcoin as legal tender when it was officially announced by their president in June 2021.

The Salvadoran government approved bitcoin as legal tender in a country with almost 70% of people outside of the banking system and a large portion of their productive population living abroad since 2006. Bitcoin as legal tender addresses these two issues.

Before we start talking about the financial solutions bitcoin gives to El Salvador, we need to remember what Legal tender means and how it is applied:

Long Term Plan For Building Out The Infrastructure Of The Country.

In September 2021, El Salvador began requiring all businesses to accept bitcoin and follow Article 102 of the Constitution of the Republic: “The State is under the obligation to promote and protect private enterprise, generating the necessary conditions to increase national wealth.”

It is believed by many in the bitcoin community that by 2025 several other nation states will adopt bitcoin. El Salvador in 2021 wanted to ensure that their citizens and future investors would have an advantage as other countries acquire bitcoin. This enables them to build out the country’s infrastructure prior to that coming adoption. Other countries have come to El Salvador to better understand the transition and how they can apply it to their countries.

In the last year, El Salvador has seen foreigners promoting international projects that have a positive impact on the economy. These projects include medical institutions, tourism and other investments that have created job opportunities for Salvadorans. They have also instituted security measures to encourage people to visit El Salvador and invest. El Salvador continues to look for investments to continue to build out the local infrastructure.

Because of the adoption of bitcoin, those citizens who left in the diaspora will be encouraged to return to El Salvador. When they return they will bring with them the potential to positively impact the Salvadoran economy.

The Largest Investment Bet In History

Remittances have gone to investment, no longer to consumption, and there are more than 100 projects that represent $400 million from the diaspora.

People outside of the country are enthusiastic about the change in El Salvador but because of the lack of understanding of Bitcoin, people inside are often hesitant to trust the new economic system that President Bukele instituted a year ago.

Other countries in Latin America are already attempting to replicate the Salvadoran model. Leaders from the central banks of Paraguay, Haiti, Honduras, Ecuador, Costa Rica and Dominican Republic have already had meetings with Bukele.

According to the World Tourism Organization. El Salvador is now ranked 13th out of the 15 countries listed, showing up amongst the top-performing destinations in terms of revenue in the first five months of 2022.

According to Bitcoin Magazine, the country is on track to earn $99 million more from tourism this year compared to 2019.

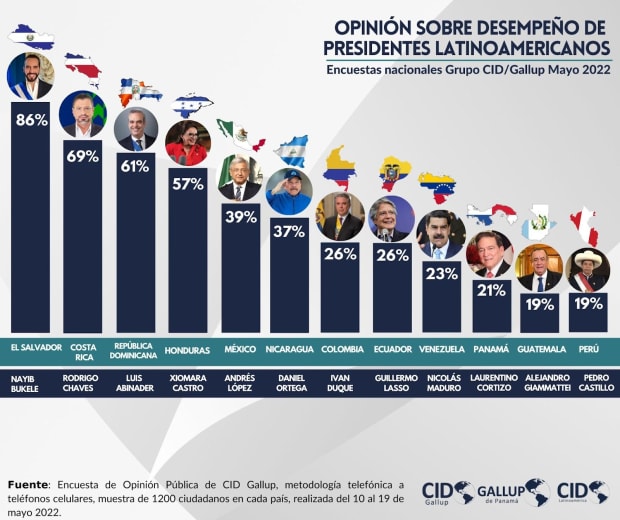

In fact, support for Nayib Bukele has increased compared to the rest of the Presidents in Latin America. The latest survey by La Prensa Grafica Newspaper gave President Nayib Bukele an 87% approval rate after three years in office. 86.8% of Salvadorans responding said that they approve of the work President Nayib Bukele has done after three years in office.

But, what do people actually think about El Salvador’s bitcoin adoption?

An anonymous citizen in El Salvador told us they have not seen any change in the economy, and that few people use bitcoin for their own transactions. People do not feel secure about the usage and implementation of bitcoin.

People are still very distrustful because they do not know if the Bitcoin network is secure. The Chivo Wallet which has been plagued with issues and has had a mixture of effects on the roll-out according to the anonymous citizen. There has not been enough education and there are very few people who have been able to educate themselves.

“There is still not enough access to the internet in El Salvador. Different plans to bring satellites did not happen yet and everything is still in the pipeline,” they stated.

El Salvador´s internet penetration rate stood at 50.5% of the total population at the start of 2022.

Despite these concerns the country continues to lean into development surrounding Bitcoin and the infrastructure necessary to facilitate this. In the end, it is yet to be seen if their bet on Bitcoin will pay off.

This is a guest post by Gaby Vivas. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.