The Bank of England is the first to pivot back to quantitative easing, claiming to restore market functioning and reduce risks of contagion.

“Fed Watch” is a macro podcast, true to bitcoin’s rebel nature. In each episode, we question mainstream and Bitcoin narratives by examining current events in macro from across the globe, with an emphasis on central banks and currencies.

Watch This Episode On YouTube Or Rumble

Listen To The Episode Here:

In this episode, CK and I got the privilege to sit down with David Lawant of Bitwise to discuss macro and its relation to bitcoin. We cover Bitwise and Lawant’s take on the current bitcoin market, price and ETF likelihood. On the macro side, we cover the U.K. emergency monetary policy change and China’s pivot on the Belt and Road lending practices.

Bitcoin Market, Price And ETF Status

We begin the podcast with talking about Bitwise and the general state of the bitcoin market. Lawant describes why he is the most bullish he has ever been on bitcoin.

As a jumping off point, we look at some charts. The first one is the daily chart and shows a support zone around $18,000 and the diagonal trend line above the current price. This pattern has been forming over a four-month timeframe, so when price breaks out of the downward sloping trend, the move should be relatively quick.

I temper the slightly bearish daily chart with the weekly chart below. As you can see, the green bar denotes a bullish weekly divergence. This is the first such divergence in the history of bitcoin! If price can close the week above $18,810 the divergence will be confirmed.

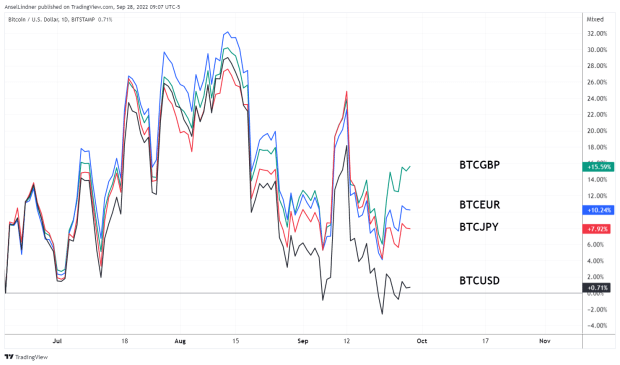

The next chart we look at during our live stream is below. It shows the price action of bitcoin since the June 2022 low in British pounds, euros, yen and dollars. It is a fascinating chart because bitcoin is acting both like a risk-on asset, selling off in times of financial crisis, and a risk-off asset, performing best against the worst currencies.

U.K. Emergency Monetary Policy Change

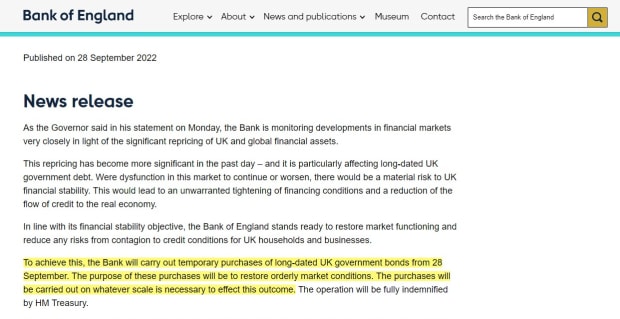

The big news of the day that we cover is the developing situation in the U.K. Due to a financial emergency, the Bank of England restarted quantitative easing (QE) on Wednesday this week.

“In line with its financial stability objective, the Bank of England stands ready to restore market functioning and reduce any risks from contagion to credit conditions for U.K. households and businesses.

“To achieve this, the Bank will carry out temporary purchases of long-dated U.K. government bonds from 28 September. The purpose of these purchases will be to restore orderly market conditions. The purchases will be carried out on whatever scale is necessary to effect this outcome.” — Bank of England

The effect of this emergency policy announcement was immediate. Below is the 30-year U.K. government bond, showing a single day move from 5.0% all the way down to 4% — a massive move as the Bank of England addresses the acute financial crisis. At the time of writing, this rate has stabilized at 4%.

The 30-year gilt started the year at barely over 1% yield, slowly making its way higher until August 2022 when the situation became more dire.

Our discussion covers many different aspects of the U.K. crisis, including whether this is the start of a global pivot from central banks. You’ll have to listen to hear Lawant’s and my predictions!

China’s Belt And Road 2.0 Lending

The last topic we cover this week is what the Chinese insiders are starting to call Belt and Road 2.0. Leaders in the Chinese Communist Party have started to realize that the financial philosophy guiding the Belt and Road was horrible. They lent out $1 trillion in financing to projects that have questionable profitability. As it stands, 60% of recipient countries of Belt and Road initiative loans are in financial trouble. In many cases, Chinese financiers are betting on the International Monetary Fund and Paris Club loans to their debtors just to get paid back. The whole thing is backfiring.

I recommend reading this article from the Wall Street Journal on the situation, and how China is attempting to solve the problem.

The last thing I’ll mention on this subject is that the Chinese are choosing a time to change their lending strategy, right when the world is going into a recession and those emerging markets need the loans the most. This could spell big trouble for countries that have previously gotten closer to China and now depend on them more than the West for financing.

This is a guest post by Ansel Lindner. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc. or Bitcoin Magazine.